Kwik Claims Inc.

From Storm Damage

To Restoration

Licensed contractor specializing in insurance claims, code compliance inspections, and maximizing your payout. We handle everything - from initial damage assessment to final warranty documentation.

The Kwik Claims Advantage

We're not just contractors - we're insurance claim specialists who understand Maryland building codes, carrier requirements, and how to maximize your settlement

10-Minute Inspection

Quick professional assessment with detailed photo documentation for your insurance claim

Code Compliance Expert

Maryland certified ensuring all work meets or exceeds local building codes and regulations

Insurance Specialists

We speak the insurance language and fight for every dollar you're entitled to receive

Full Warranty Protection

Comprehensive workmanship warranty plus manufacturer's material warranty for peace of mind

100% Success Rate

Every claim we've handled has resulted in approval and full payment to homeowners

No Upfront Costs

We work directly with insurance - you pay nothing until claim is approved and funded

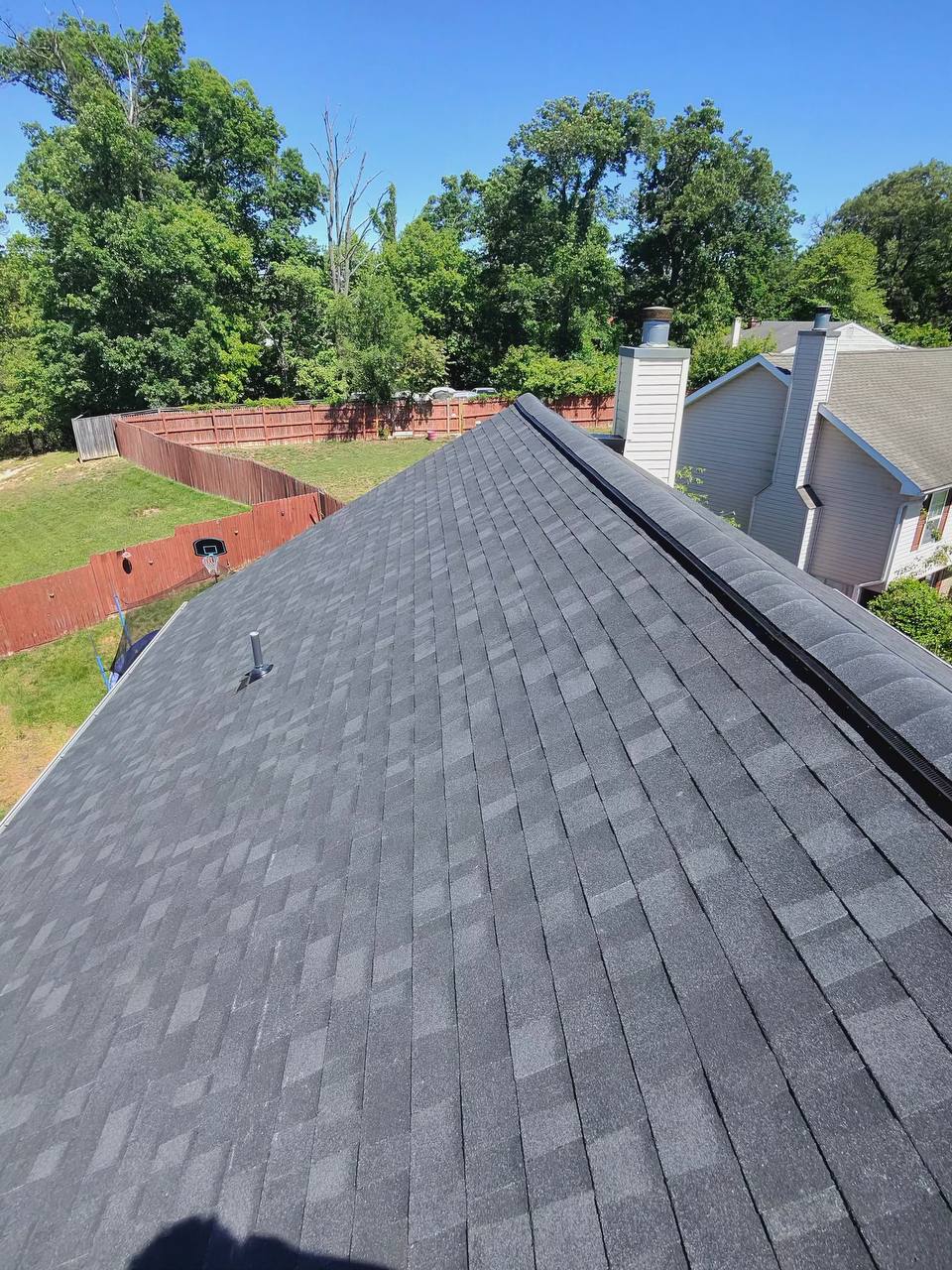

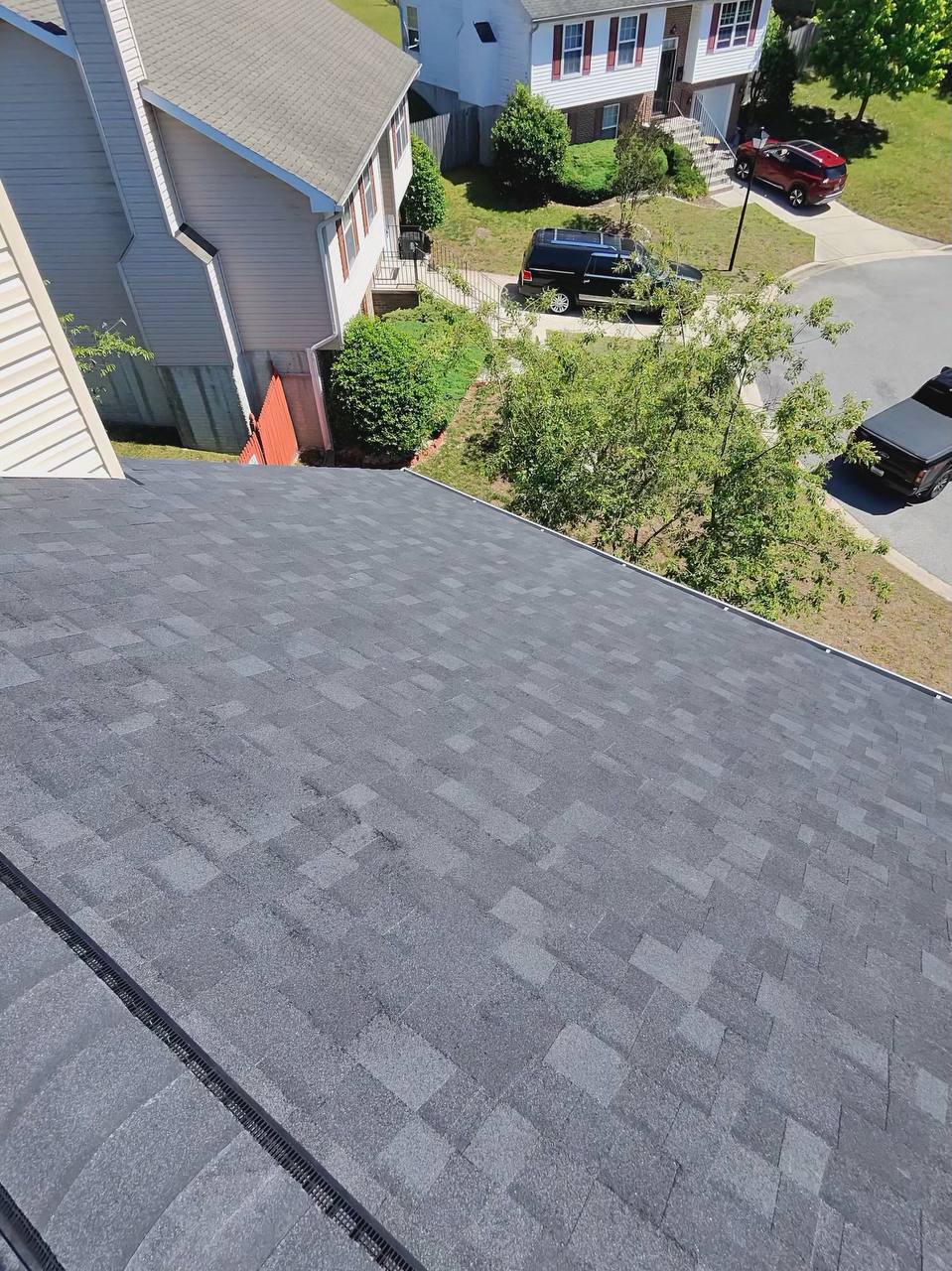

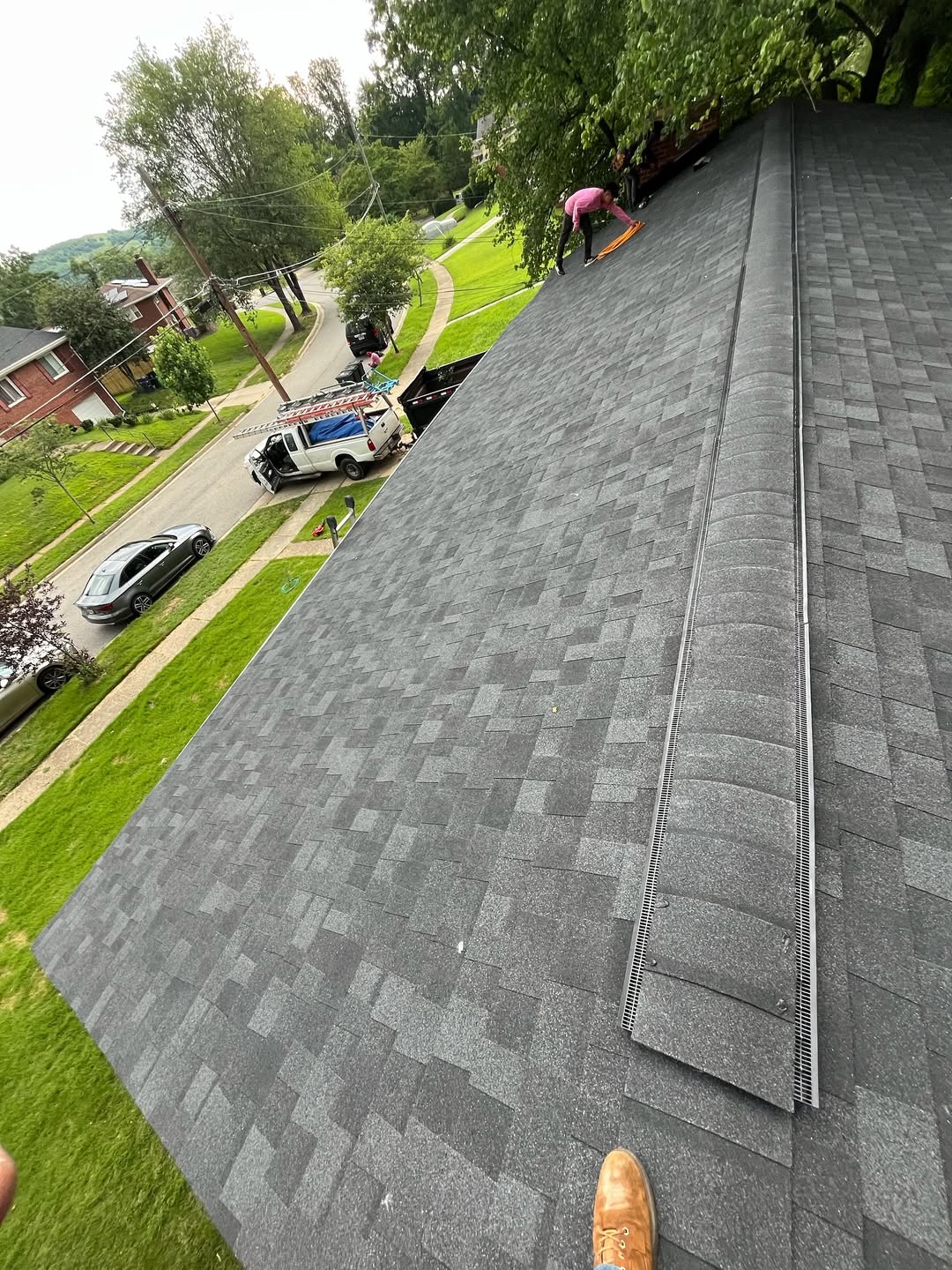

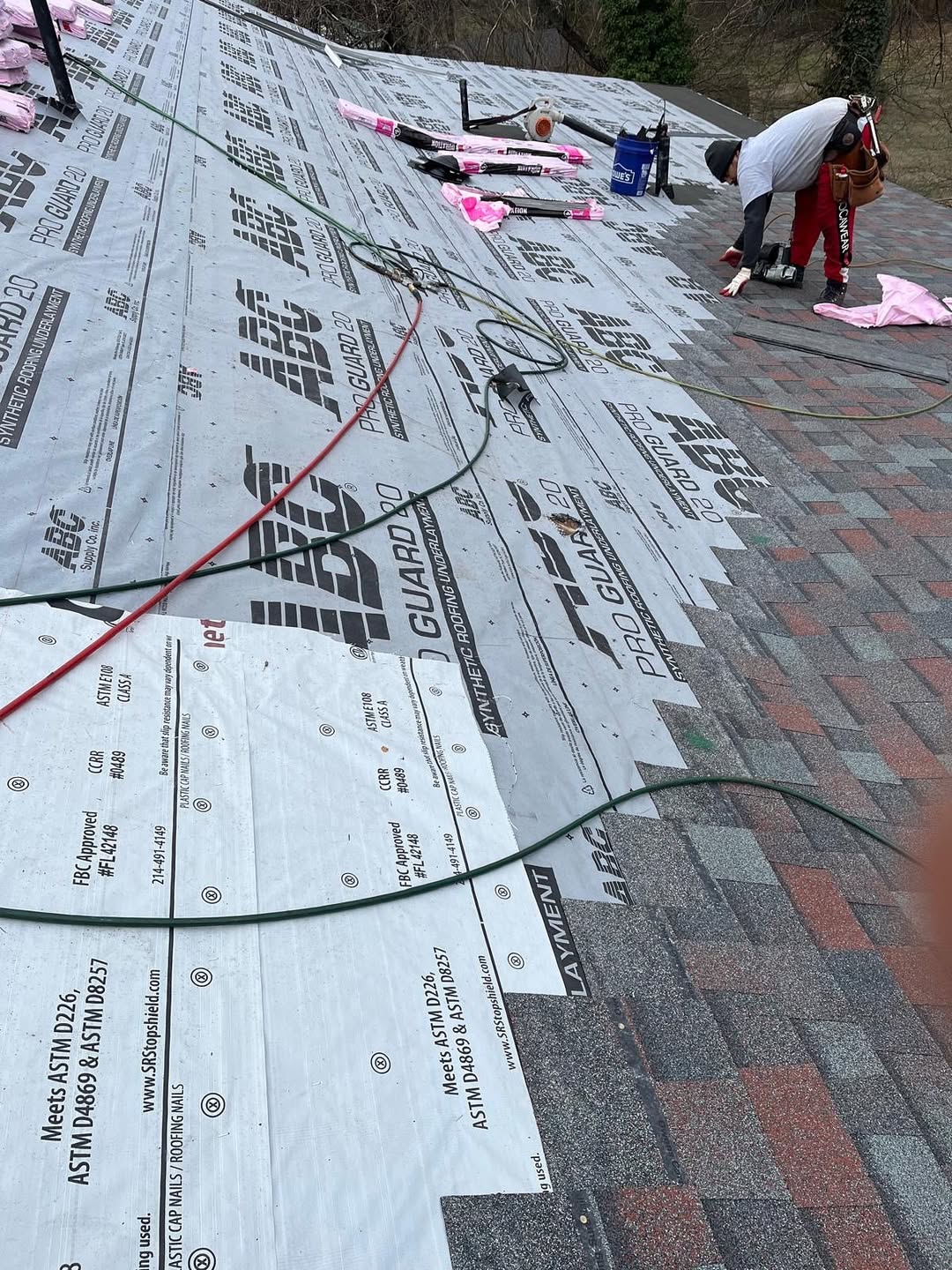

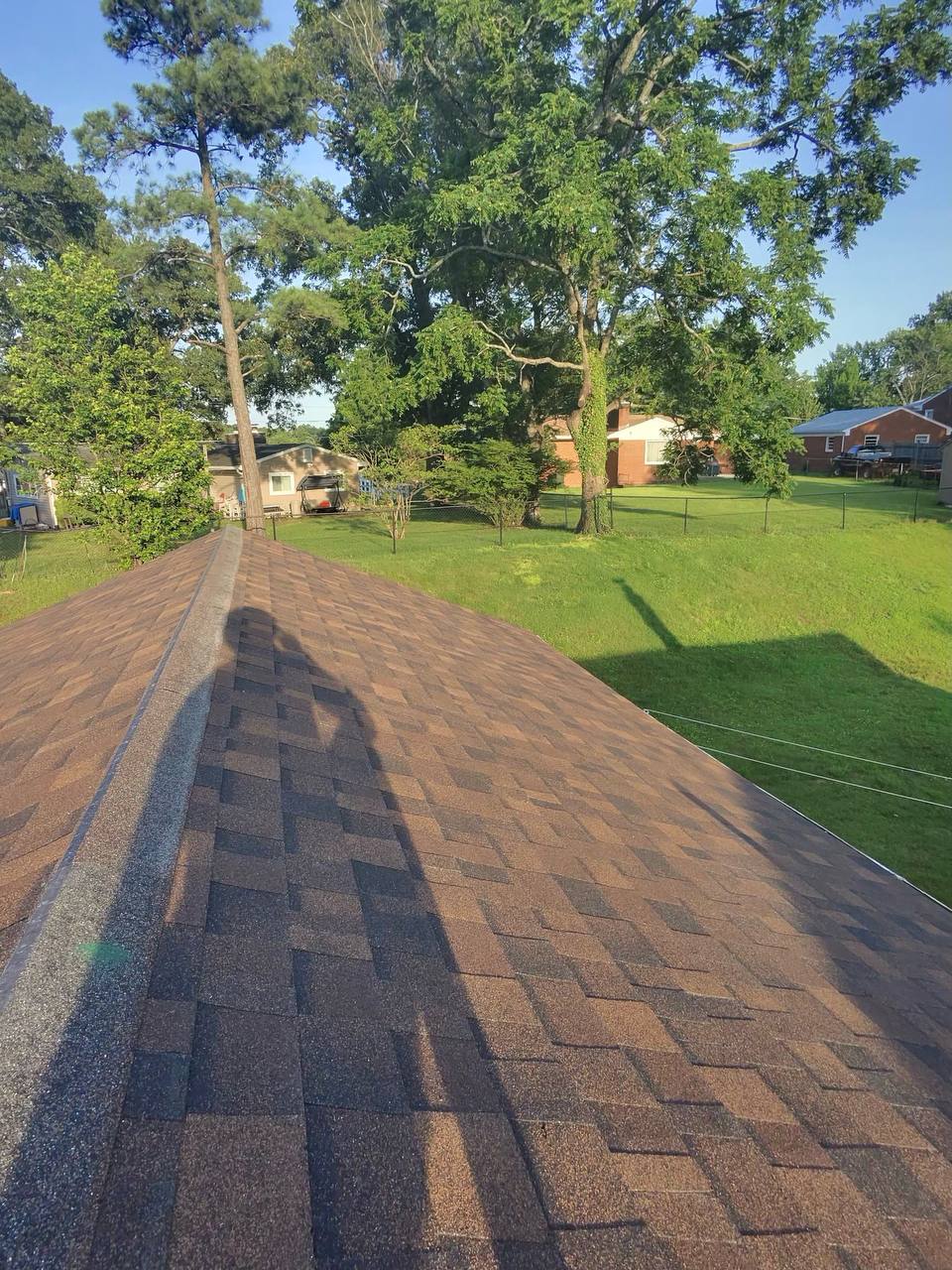

See What Storm Restoration Looks Like

Swipe or click to advance through real project photos

District Heights, MD

"They were on top of every detail, communicated clearly, and made sure we didn't have to fight with our insurance company."

Bowie, MD

"Incredible service — they handled the paperwork, met the adjuster, and kept me updated every step of the way."

Clinton, MD

"I never thought an insurance claim could be this easy. They took care of it all and got us paid quickly."

What Every Maryland Homeowner Should Know

Understanding your rights, the claims process, and common insurance company tactics can mean the difference between a denied claim and a full roof replacement

Your Policy Covers More Than You Think

Most homeowners don't realize their policy includes code upgrades, permits, and complete tear-off when two layers exist. Insurance companies won't volunteer this information.

Timing Is Critical

Maryland law requires filing within one year of the storm event. However, documenting damage immediately after a storm significantly increases approval odds and settlement amounts.

Adjusters Work for Insurance Companies

Insurance payouts are often minimized because adjusters are incentivized to favor the Insurance company. A licensed contractor during inspection ensures all damage is documented properly.

Supplements Are Standard

Initial estimates rarely cover everything. We typically file 2-3 supplements to recover additional funds for hidden damage, code requirements, and price increases.

Material Testing Matters

ITEL testing proves manufacturer defects and storm damage that's invisible to the naked eye. This scientific evidence makes claims undeniable.

You Have Rights

Maryland law protects homeowners from bad faith insurance practices. You're entitled to full replacement value, not depreciated amounts.

Real Results, Real Cities

We protect homeowner privacy by only showing city & state on public listings

Bladensburg, MD

"They advocated for us from start to finish and made sure nothing was missed in the claim."

Fort Washington, MD

"Professional, courteous, and relentless — exactly what we needed to get our roof replaced after the storm."

Oxon Hill, MD

"I felt completely taken care of. They handled the insurance company while I focused on my family."

Our Complete 6-Stage Insurance Process

Every successful claim follows this exact blueprint. From initial consultation through final warranty, we manage every detail, deadline, and document to ensure maximum payout

Add your property and basic information to our claim management system

Sign agreement outlining our services and your rights

Comprehensive photo documentation and detailed damage notes

Identify all Maryland building codes affecting restoration requirements

Determine if materials can be repaired without causing additional damage

ITEL and laboratory testing to scientifically prove damage

Precise roof measurements using satellite and on-site verification

Professional summary of claim for insurance carrier

Document all applicable costs for reimbursement

Create comprehensive carrier-facing documentation package

Professional submission to adjuster and carrier

Organize all claim documents in carrier's system

Coordinate inspection date that works for all parties

Attend inspection, advocate for full scope, document everything

Review and analyze carrier's estimate for accuracy

Confirm approved scope and negotiate any discrepancies

Calculate and record complete project budget

Ensure initial ACV payment is received and correct

Green light to begin restoration work

Detailed work agreement with specifications

Execute installation plan with certified crews

Lock in schedule based on weather and materials

Verify current pricing and availability

Finalize crew scheduling and pricing

Purchase all materials with proper documentation

Execute all primary work to code standards

Obtain homeowner sign-off on completed work

Document any additional or unexpected costs

Build comprehensive supplement for missed items

Professional submission for additional payment

Ensure all paperwork is properly filed

Ensure all supplemental funds are received

Complete financial breakdown for transparency

Track all payment phases for completion

Purchase materials for approved additional work

Release funds for additional scope items

Finish all additional approved repairs

Obtain comprehensive workmanship warranty

Deliver complete warranty documentation package

Complete accounting with all receipts and proof

Finalize file and provide ongoing support

Our Work Across Maryland

Every project represents a homeowner who trusted us with their insurance claim. Browse our portfolio of successful restorations throughout PG and Montgomery Counties

Temple Hills, MD

"They made sure our home was restored better than before and walked us through every step."

Fort Washington, MD

"From inspection to final payment, everything was smooth and stress-free."

Temple Hills, MD

"Their knowledge of insurance claims is unmatched — they made sure we got everything we were owed."

District Heights, MD

"Efficient, thorough, and professional — I recommend them to everyone dealing with storm damage."

Understanding Storm Damage & Your Rights

Maryland experiences severe weather year-round. Wind, hail, and heavy rain cause damage that's often invisible until it's too late. Know the signs and protect your investment

Maryland Storm Statistics

Our region averages 30+ severe weather events annually with winds exceeding 40 mph. Recent storms have produced gusts up to 76 mph, causing widespread damage.

Hidden Damage Reality

80% of storm damage isn't visible from the ground. Lifted shingles, compromised seals, and granule loss require professional inspection to identify.

Age Matters

Roofs 10-15 years old: vulnerable to 30-40 mph winds

Roofs 20+ years old: damage possible from 20-30 mph winds

Your Insurance Rights

Maryland law entitles you to: Free inspection, full replacement value, code compliance upgrades, and protection from bad faith practices.

Shingle Wind Resistance Degradation

Scientific data showing how roofing materials lose strength over time

⚠️ Critical Finding

Most Maryland roofs lose 50% of their wind resistance after just 10-15 years. With our frequent storms, this puts your home at significant risk for damage that insurance will cover.

Ready to Protect Your Investment?

Join 500+ Maryland homeowners who've successfully navigated their insurance claims with our expert guidance

Free 10-Minute Roof Inspection

- Professional damage assessment with photo documentation

- Insurance claim viability analysis

- Code compliance evaluation

- No obligation - No upfront costs

- Same day response guaranteed

🚨 Available 24/7 for Storm Emergencies